Blogs

Are you looking to take a leap of faith into the emerging field of blockchain innovation? Launching a cryptocurrency is the equivalent of that! You’ll need this guide to transform a visionary idea into a formidable digital asset. From disrupting finance to creating the next big thing, let’s delve into the crypto world and make it happen!

The foundation of any successful cryptocurrency lies in its purpose. What problem does it solve? What makes it unique?

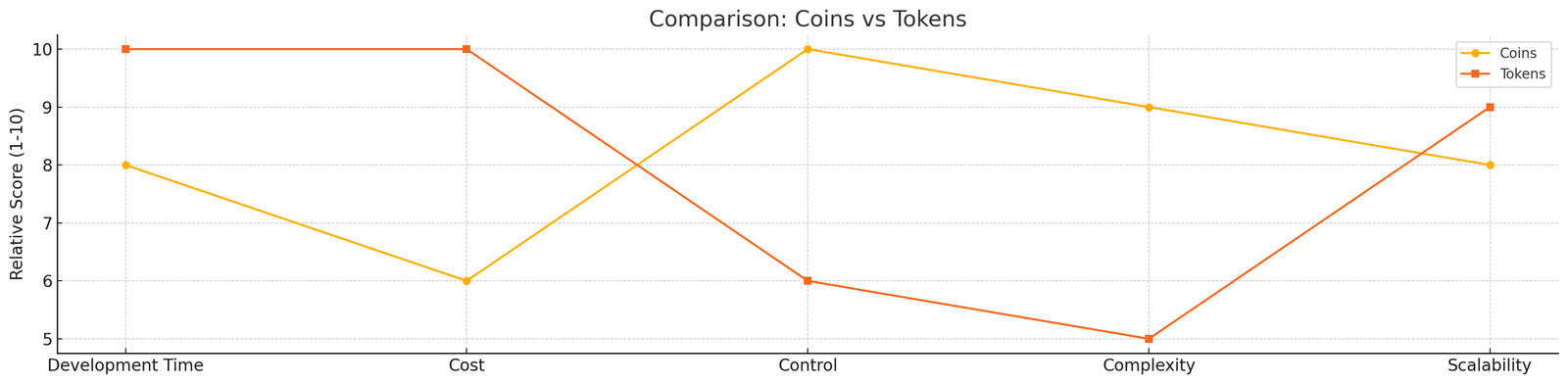

It is vitally important to know the distinction between coins and tokens. Both play unique roles in the blockchain ecosystem and comprehending their differences will aid you in clearly defining your project’s purpose!

Coins are autonomous digital currencies that are native to their blockchain. Usually, they carry out functions like processing payments, rewarding network users, or acting as a value store. Among the examples are:

Bitcoin (BTC): Since it is a decentralized digital currency used for transactions between peers and as a store of value, it makes international and autonomous payments without any third-party involvement.

Ethereum (ETH): provides funding for transactions and the implementation of smart contracts on the Ethereum blockchain.

For instance: Litecoin is utilized for international transactions.

For instance: Bitcoin provides a lifeline for individuals seeking financial stability in depreciating fiat currencies, such as in nations like Venezuela.

For instance: Use Polkadot or Cardano for blockchain operations.

Existing blockchains such as Ethereum, Binance Smart Chain, or Solana are used to produce tokens. They utilize the framework of the host blockchain rather than creating an entirely new one. Tokens are easier and faster to develop, often created to power specific applications or ecosystems.

AXS (Axie Infinity): AXS is useful in breeding and marketing digital creatures.

Security Tokens: Tangible assets such as real estate, bonds, and/or stocks can be owned via these tokens. However, these must comply with financial regulations.

Governance Tokens: Gives users a say on governance and project decisions.

Utility Tokens: Permits users to access real-life services or products.

Example: DeFi tokens like AAVE enable decentralized lending and borrowing.

Tip: Depending on the objectives of your project, the assets at your disposal, and the degree of control you need, choose between developing a coin and a token. Make a coin if your goal is to create a self-regulating ecosystem. Consider a token if you want to install it more quickly within an existing network!

Your choice of blockchain determines the foundation of your cryptocurrency.

Develop a blockchain with unique features tailored to your needs.

Save time by creating tokens on platforms like:

For example, it is essential to establish a name, symbol, total quantity, and decimals to create an ERC-20 token. Development tools such as Remix IDE should be utilized.

The development process varies depending on whether you’re building a coin or a token.

Pro Tip: Focus on user experience. Seamless wallet integration and clear transaction history tools can set your project apart.

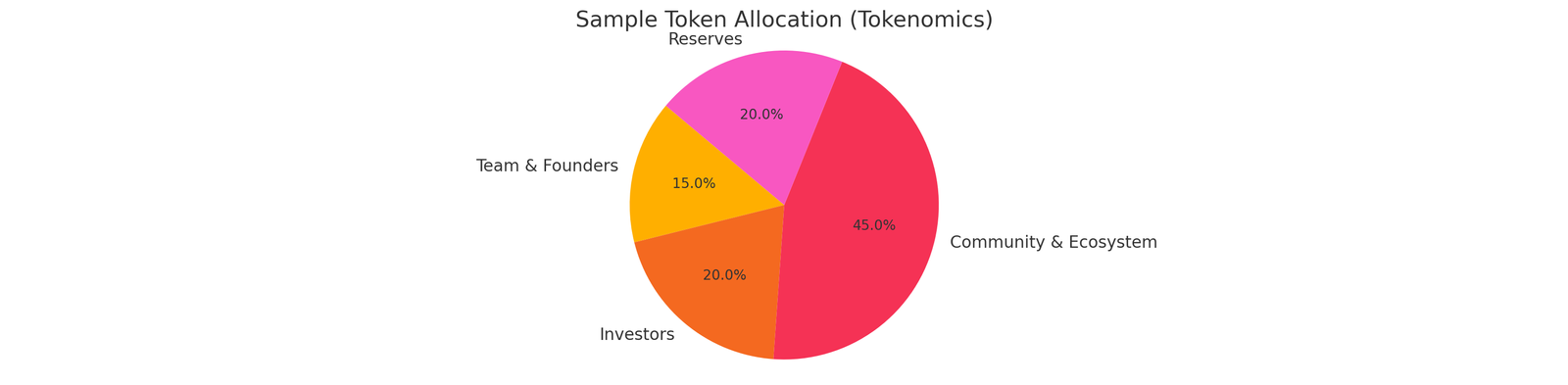

The study of a cryptocurrency’s core properties, or tokenomics, can assist you in assessing tokens and arriving at decisions with greater knowledge. Among many other things, it considers characteristics like market capitalization, supply, inflation or deflation, the distribution of new tokens, and utility.

Example: To lower supply and raise value, Binance Coin (BNB) uses regular token burns.

The crypto space is rife with risks. Robust security measures and regulatory compliance are essential.

Pro Tip: Transparency builds trust. Publish audit reports and compliance efforts publicly.

Launching your cryptocurrency effectively requires technical execution and strategic outreach.

The real-time version of your blockchain or token, known as the mainnet, is where actual trades take place and assets are worth money. In contrast to the testnet, which is meant for experimenting and testing, without any financial risks, the mainnet is the network that is ready for production. For example:

Tip: To prevent expensive mistakes or weak spots, meticulously test your digital currency on a testnet (such as Rinkeby for Ethereum) before releasing it to the mainnet.

Success requires ongoing effort. Track performance, gather feedback, and refine your strategies.

Conclusion: Starting a cryptocurrency is a thrilling endeavor that integrates technological advancement, socially driven growth, and invention. You’re not merely producing a digital asset; you’re influencing the direction of decentralized economies by precisely defining your goal, developing strong tokenomics, maintaining security, and cultivating a thriving community. Every stage offers a chance to differentiate yourself in the ever-changing cryptocurrency market, from conceiving your idea to interacting with your audience. Your project can become a long-lasting pillar of the blockchain revolution with the correct mix of ingenuity, planning, and perseverance. The future is decentralized, will your cryptocurrency be part of the story?

© Copyright 2025 Markeltree All Rights Reserved.